Charitable State Registration Solutions

Why are charity registrations important?

The process of compliance for solicitation registrations can be confusing and constantly changing. We are here to help with all aspects of the process, including preparation of forms, completing extensions, providing registered agent services, and ensuring all documentation is submitted promptly. We follow up with the states to ensure we have the most up-to-date information. We focus on your compliance needs so you can fundraise knowing that your registrations are handled.

Let us do the work so you can focus on your mission

MP May staff has over thirty years of experience helping non-profits ensure compliance with charitable solicitation registration initial and renewal filings, corporate annual reports, registered agents, and so much more. Our secure online portals provide easy use and access to all the information you need throughout the process. Our staff ensures you always receive excellent service and prompt responses to your questions. We ensure that all staff can answer any customer questions.

Helpful Resources

what is best for your organization?

Full or Limited Compliance Plans

Contact MP May to discuss what is best for your organization.

FULL COMPLIANCE

41 states (including Washington DC)

5 states with registered agents

LIMITED STATES

Select the states you wish to solicit in

Frequently Asked Questions

What organizations are required to register?

Any charity that solicits contributions or support in a state that requires registration must register in that state. What constitutes “solicitation” is different in every state but many have broad interpretations so to be prudent it is critical to maintain proper compliance.

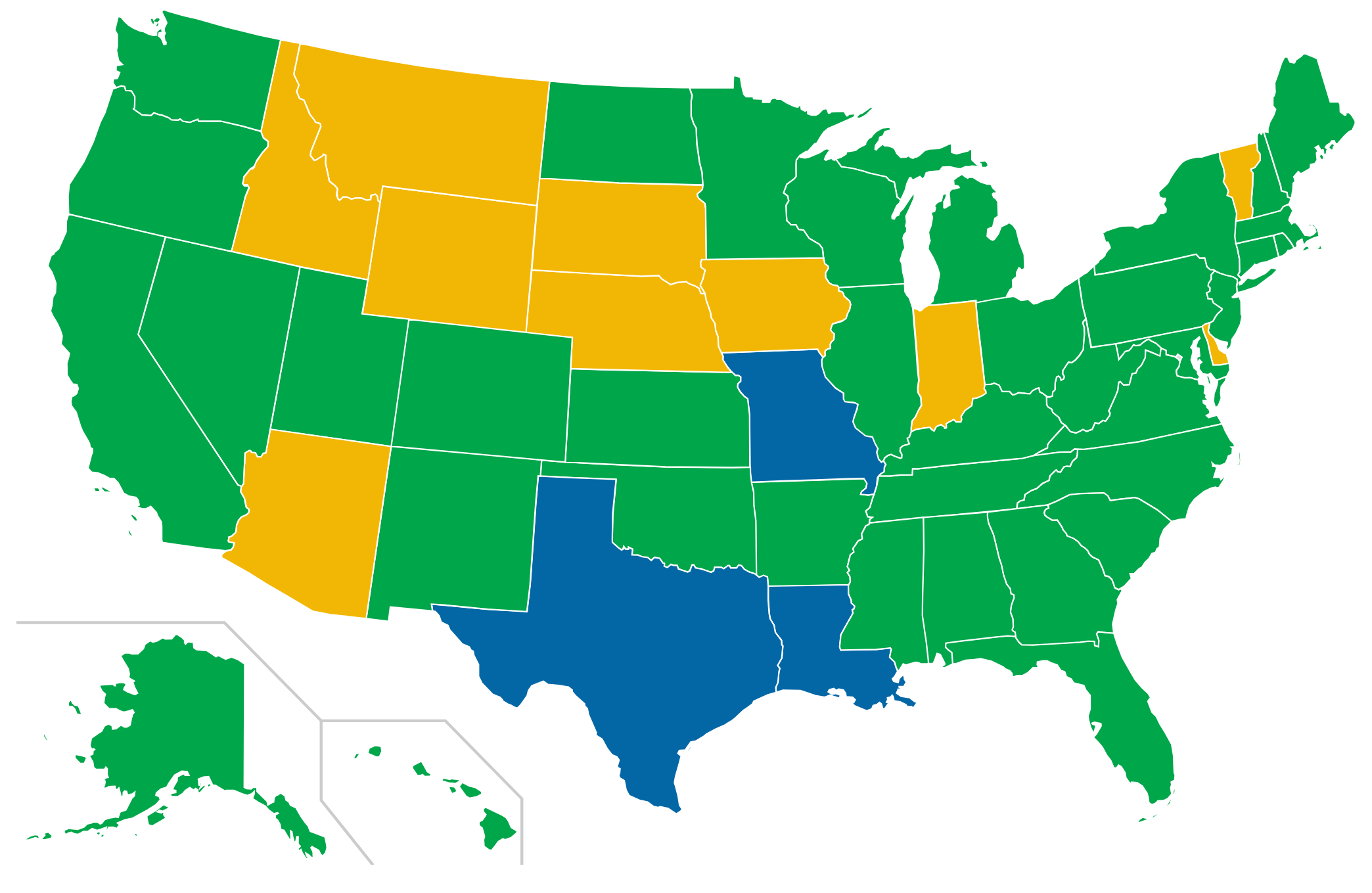

Do we need to be registered in all 50 states?

There are currently 40 states plus the District of Columbia that require registration. Eight states require a Corporate registration. Some states require that you have a registered agent. We help you navigate all of the different requirements and can provide all of these services to you. You can choose to only register in certain states but may be required to return donations from states where registration is required to avoid penalties.

Do we only need to register once?

No. After the initial registration most states will require a renewal registration or at a minimum an annual report each year. We keep track of those deadlines for you so nothing gets overlooked. Especially when nonprofit turnover is so high, it is beneficial to have someone else looking out for your organization.

Are there penalties for failing to register?

Yes. This is different for each state and include but are not limited to monetary fines, civil and criminal penalties, and loss of solicitation privileges. Officers and board members can also be liable for non-compliance.

Is there one central location where we can register for all states at once?

No. There is not a public location to do this. Each state has its own paperwork and requirements.

Can my organization handle these registrations on our own?

You could but it is difficult to understand the different requirements of each state. It is very time consuming to complete all of the registrations. This is time that is spent away from serving your clients and focusing on your mission. If you have staff changes, these registrations could fall by the wayside which could cause you to miss a deadline and fall out of compliance. Using the experts at MP May you know that your registrations will always be taken care of.

What is a registered agent?

Some jurisdictions require an organization that solicits in that state and does not have a local office to have a registered agent with a local address. The registered agent is a legal representative who can receive official documents on behalf of the organization.

How much are nationwide registration fees?

An arrangement with a for-profit business to receive a percentage of sales. These are often referred to as “charitable sales promotion” or “cause marketing”. This is a regulated activity in many states.

What is a commercial co-venture?

The registration fees vary by state and type of organization. Some fees are based on income. Some states require a financial audit prepared by an accountant. The general range of state fees for initial nationwide registrations is between $1,700 and $3,600 but could be more for very large nonprofits.

What if I am already registered in some states or use another vendor to do my registrations?

When you contact MP May we will always perform a thorough review of your current registrations so we can confirm for you where you are registered and identify future renewal dates as well as any concerns. Then we will show you how we can help you moving forward.

How can I get a quote from MP May?

Contact us. We will be in touch to learn more about your organization’s needs. We provide a thorough review of your current registrations in advance of providing you a quote.